Government borrowing went up in November as the UK continued to fund the economy during the coronavirus epidemic.

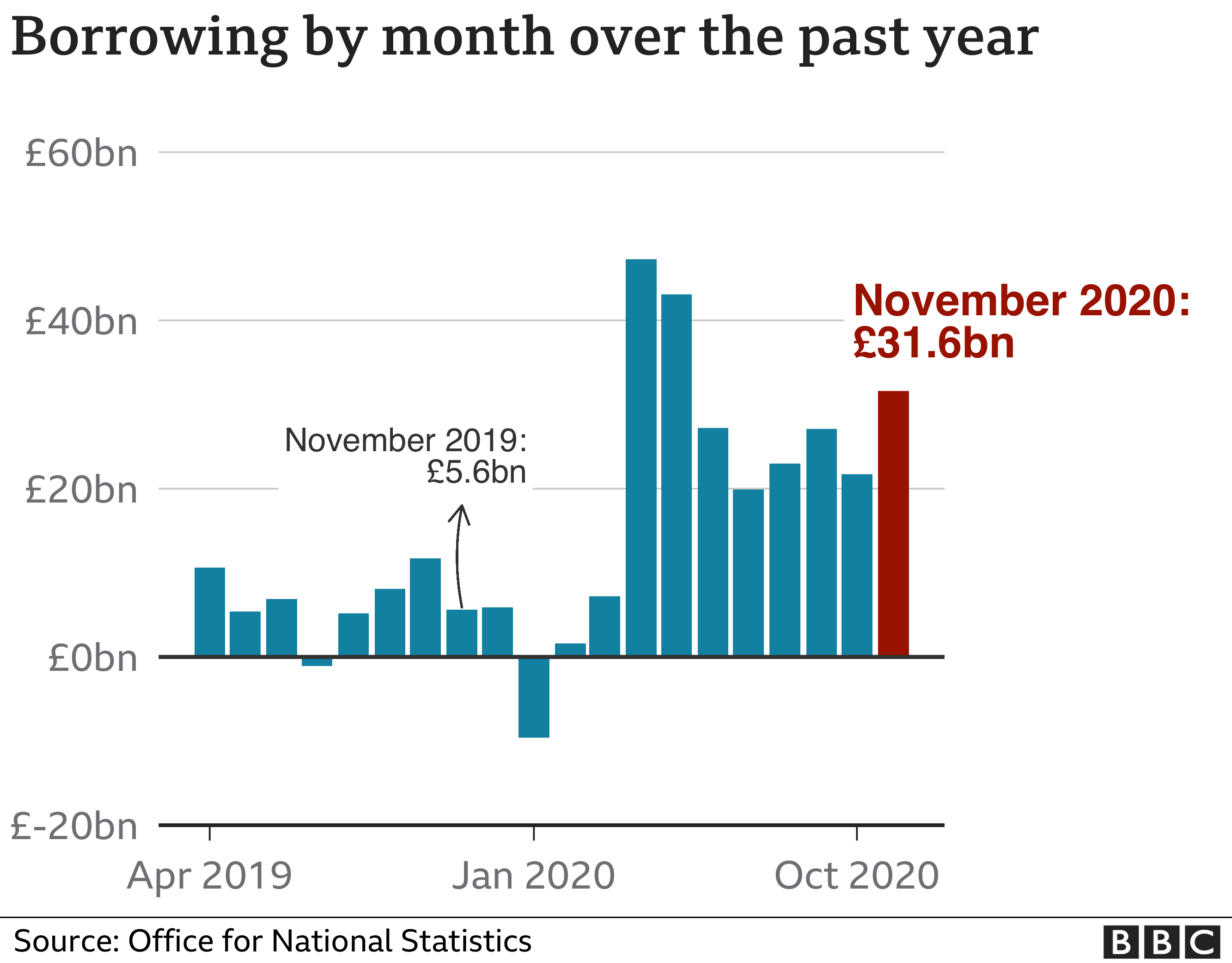

The National Bureau of Statistics said borrowing hit £ 31.6bn last month, the highest in November.

It was also the third-highest figure in any month since records began in 1993.

Chancellor Of The Exchequer Speaks

The figures highlight the government’s spending gap, and highlight Chancellor Rishi Sunak’s problems as he survives on the Treasury’s tightening budget.

Since the start of the financial year in April, borrowing has reached £ 240.9bn, £ 188.6bn more than last year, the ONS reported.

The budget was expected to take place in the fall of this year, but it was delayed due to the epidemic and will now be on March 3, 2021.

The Independent Financial Institution (OBR) estimates that borrowing could reach £ 372.2bn by the end of March.

However, Mr Sunak made it clear on Tuesday that he would not take any immediate action. “As our economy recovers, it is only right that we take the necessary steps to put public finances at a sustainable level so that we can address future challenges in the way we have done this year,” he said.

Mr Sunak has already set a salary cap of about 1.3 million government employees as part of a government fundraising effort.

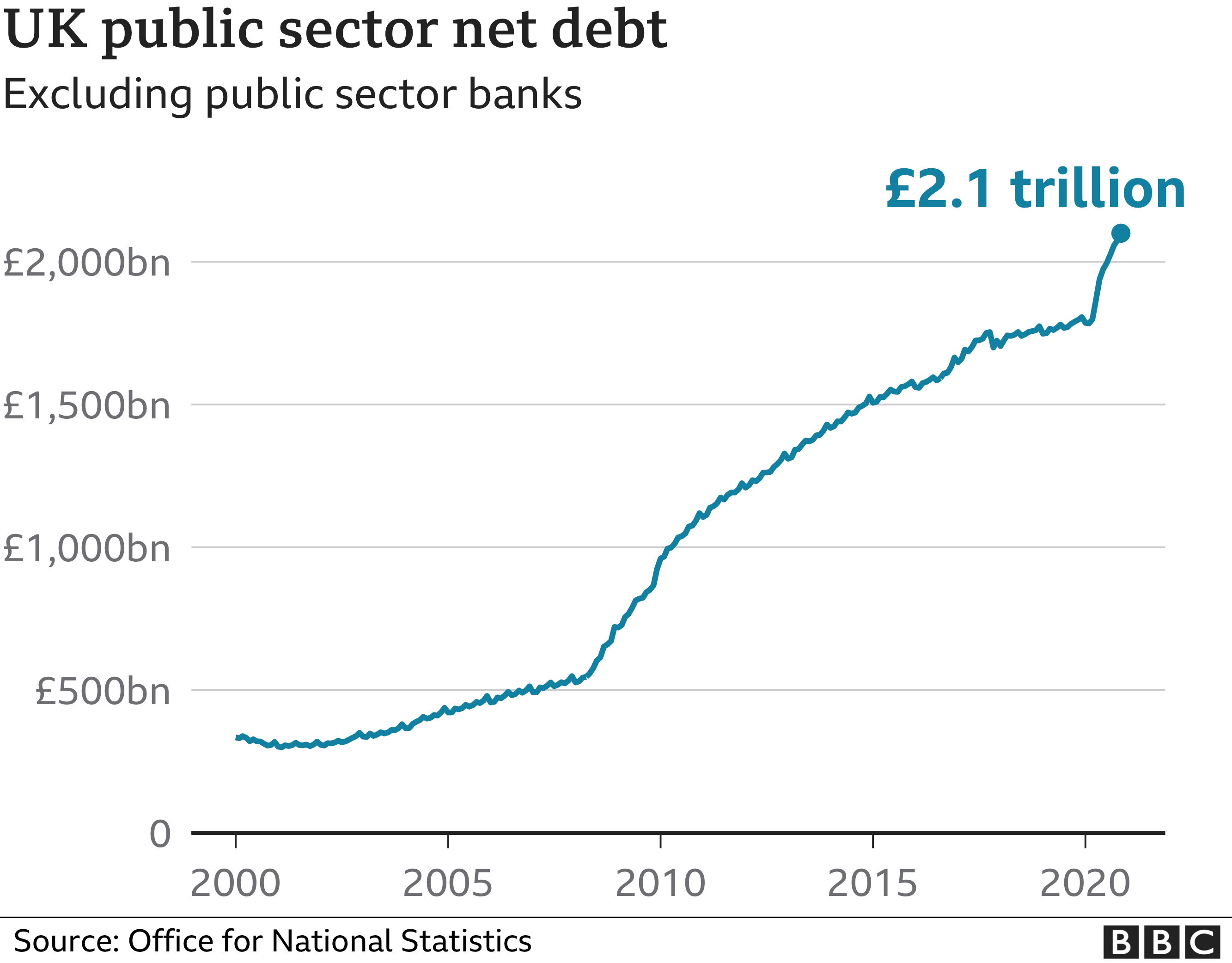

The increase in borrowing has led to a sharp increase in national debt, now standing at just under £ 2.1 trillion.

The UK’s total debt has now reached 99.5% of gross domestic product (GDP) – a level that has not been seen since the early 1960s.

Where Is The Money Borrowed From?

The government borrows from the financial markets, by selling bonds.

A bond is a promise of payment to anyone in charge on certain days. There is a huge payout on the last day – in fact, payment.

Buyers of these bonds, or “gilts”, especially financial institutions, such as pension funds, investment funds, banks and insurance companies. Private storage also buys them.

“We are looking at the highest backlog in peacetime and if we look at where the country’s debt is, then we have been at a high level since the 1960s,” said Sarah Hewin, an economist at Standard Chartered.

“In November alone, borrowing was almost six times higher than in November last year, so these are the fully recorded figures we see.

“Also, the furlough system has been expanded, so that will increase government spending. We can clearly see the deficit for the financial year up to 20% of GDP, so it’s about £ 400bn.”

Separately, the ONS is also reviewing its UK economic growth figures this year.

The economy has shrunk slightly over the period April-to-June than previously reported, by 18.8% instead of 19.8%.

And refunds from July to September were larger, with a growth of 16% instead of 15.5%.

Ruth Gregory, a UK economist at Capital Economics, said a double downturn would be a clear indication that the four Covid-19 limits would be extended by 2021.

However, he said it was hoped that as long as the vaccine was effective and widespread, GDP would “bring a strong backlash” in the second half of next year.

Unusual numbers of loan coverage loans have begun to recover. But last month, as more restrictions were re-applied across the UK, the government borrowed £ 31.6bn, the third highest month in history.

This was £ 26bn more than in November last year, largely driven by a £ 23bn increase in government spending over the past year, including the reintroduction of a comprehensive employee benefit plan.

Borrowing so far this financial year from April is already a record £ 240bn and is expected to hit around £ 400bn a full year.

Economic growth in the third quarter was slightly higher than the first estimate, at a record 16%, but that is now solid old news.

The possible spread of new trade and hospitality barriers and the many forms of turmoil in the ports mean that weather forecasters fear that the UK may already be back in a recession.

Leave a Reply

You must be logged in to post a comment.