News

News

UK’s Major Stock Index ‘FTSE 100’ Witnesses Worst Year Since 2008

Pension savers and investors’ nest-eggs have been hit as the UK’s leading share index had its worst year since the height of the financial crisis.

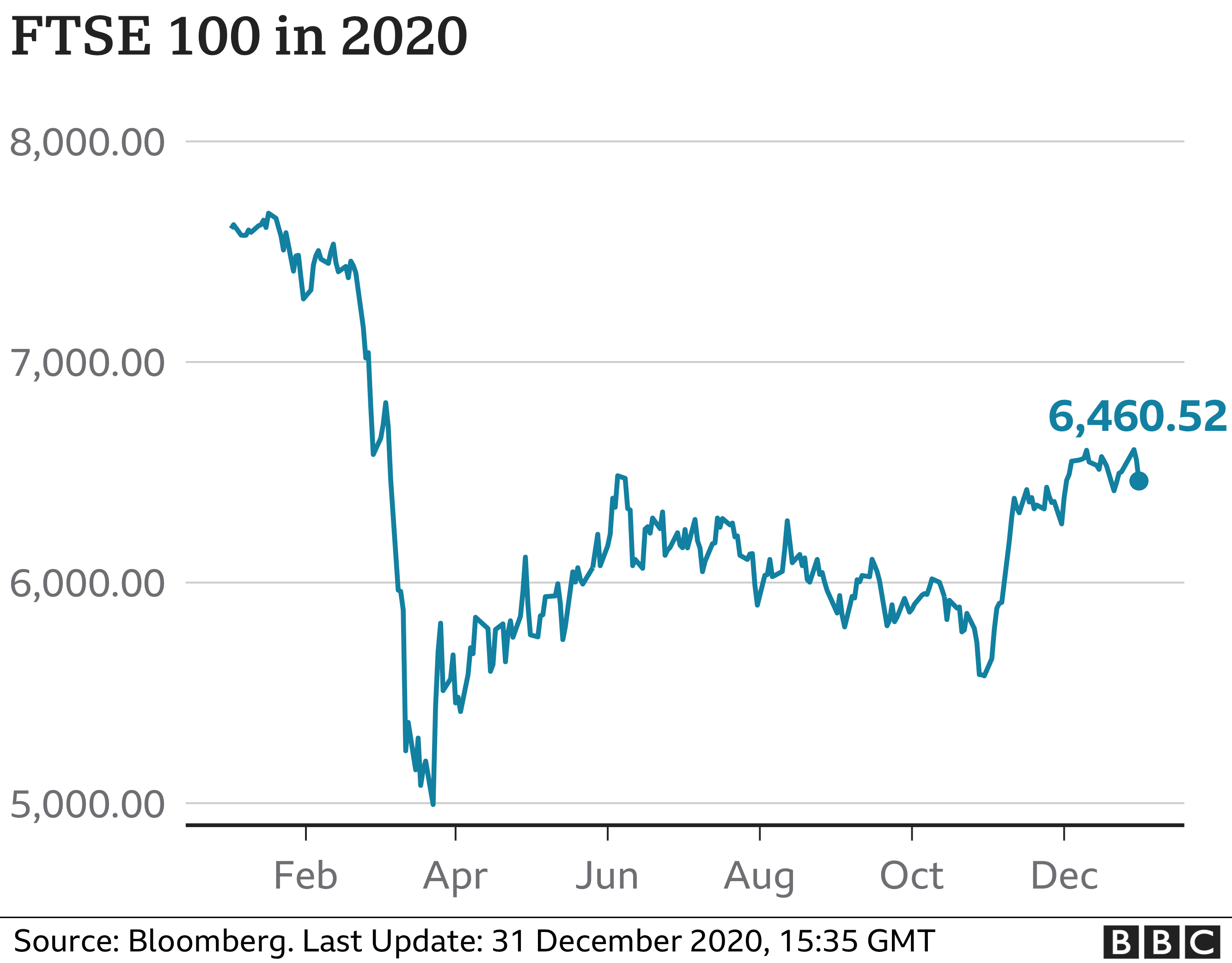

The FTSE 100 index fell 14.3% over the year, marking its worst performance since 2008, when it slumped 31.3%.

Pandemic, Recession, And Brexit

Despite the poor performance, the blue-chip index has recovered significantly since the start of the global pandemic when it was a third lower than now.

Analysts have said that next year is likely to be better for investors.

“The factors which worked against the FTSE-100 in 2020 – the pandemic, a deep recession and Brexit – will start to fade into the background, giving corporate profits, dividends and employment a chance to bounce back,” said Russ Mould, investment director at AJ Bell.

Such market volatility can be alarming, but people should not panic. Anyone who sold shares back in March would have missed out on the market’s gains we’ve seen since, for instance.

How This Affects People Not Involved In Stock Market?

Market movements don’t only affect savers with shares or funds that invest in the stock market. They also affect anyone with a pension scheme, as the money we stash for our retirement is invested on our behalf in the market.

That means millions of workers in the UK are relaying on stock market returns for their financial future.

Seasoned investors and fund managers are constantly taking action to protect their portfolio. That can mean moving cash out of risky markets or moving into safer cash havens, such as bonds.

It’s essential to diversify and not back just one investment opportunity, which is what funds are all about. By avoiding having all your savings in one basket – or share – then you avoid falling prey to the worst volatility of stock markets.

“The coronavirus market downturn spurred many young people to dip a toe into the world of investments for the first time – perhaps because they have been at home more,” pointed out Myron Jobson, personal finance campaigner at Interactive Investor.

“The key for investors of all ages is to ensure that your portfolio is well diversified across assets, sectors and regions so that you are not overexposed to risk in any one part of the market.”

Expert Comments

“If 2020 taught us anything it’s that predicting short-term movements in the stock market is impossible,” Robin Powell, editor of The Evidence-Based Investor told the BBC.

“Investors should check that they’re happy with the level of risk they’re taking, and if they are, they should ignore the noise and stay invested, rebalancing periodically.”

He advises people to have a portfolio you can stick with through thick and thin, diversified across regions and sector, and that includes a percentage of government bonds to dampen the risk.

“And don’t pay for help from anyone who thinks they know where markets are heading. They have no more of a clue than you do,” he cautioned.

Mr Mould conceded that it has been hard to find a decent return in 2020 with interest rate cuts, falling returns from National Savings products and lower Government bond yields.

But if you put your money overseas, the story could have been different. “Japanese and US stock markets both had solid years and America’s tech-laden Nasdaq soared by over 40%,” he pointed out.

That’s a point taken up by Michael Baxter, economics commentator for The Share Centre.

“Compare the FTSE-100 with the US equivalent,” he said. “The S&P 500 surged this year hitting a new all-time high. By contrast, the FTSE 100 fell sharply.”

He attributes that to the tech sector making up a high proportion of the US index.

“The COVID-19 crisis has accelerated a trend that was already in place before, namely the adoption of digital.

“By contrast, the FTSE 100 is made up too many companies with their base stuck in the past, trying to promote 20th century business models in the 21st century and Covid just served to make a bad situation worse.”

Recent Posts

- Feeling the Pressure at 25–30? Here’s Why Young Adults Think Time Is Running Out

- BTS Is Back! All Seven Members Complete Military Service—What’s Next for the K-Pop Kings?

- Diddy’s Blockbuster Trial Nears Verdict: What’s Next for the Hip-Hop Mogul?

- “Squid Game” Final Season Sparks Global Buzz Ahead of Premiere

- Beyoncé and Jay-Z Reunite Onstage in Paris: A Night to Remember

- Texas Bets Big on Film: $1.5 Billion Incentive Law Aims to Bring Hollywood Home

- Starbucks Considers Selling Its China Business Amid Fierce Local Competition

- JetBlue Retreats from Miami and Seattle Amid Mounting Financial Pressures

- Barbra Streisand Calls Out Hollywood’s Pay Gap in Meet the Fockers Revelation

- Elon Musk’s Robotaxi Revolution: A Cosmic Ride into the Future