News

News

The Week Ahead For The US Stock Market

Shares next week will come out of one of its best months until a busy week of economic data and ongoing tensions between the virus spread and good news about vaccines and treatment.

Another highlight this week is expected to be Tuesday’s testimony from Fed Chairman Jerome Powell and Finance Secretary Steven Mnuchin before the Banking Senate Committee. They will be talking about the immediate steps taken to help the economy in the aftermath of the pandemic.

Dow And The S&P In November

The Dow has been up about 13 percent in November so far, and if it gains by the end of Monday, it will release its best month since January, 1987. The S&P 500 closed with a record 3,638 and up 11.3% a month. Profit its excellent performance since April 12.7%, which was the third month of the S&P 500 since its inception in 1957.

November has also been a major month of market exchange, with investors interested in stocks that will benefit from a growing economy and show little love for long-held favorites between big tech names and the internet. Funds have risen by more than 17% last month, and industry has increased by about 15%, as investors bet on drugs that will help the economy return to normal next year.

The Tech Sector Was Lagging

Tech earned a one-digit monthly gain so far and remained slower in the wider market. But some strategists are expecting big names for tech and the internet, home-based stocks, to perform better in December.

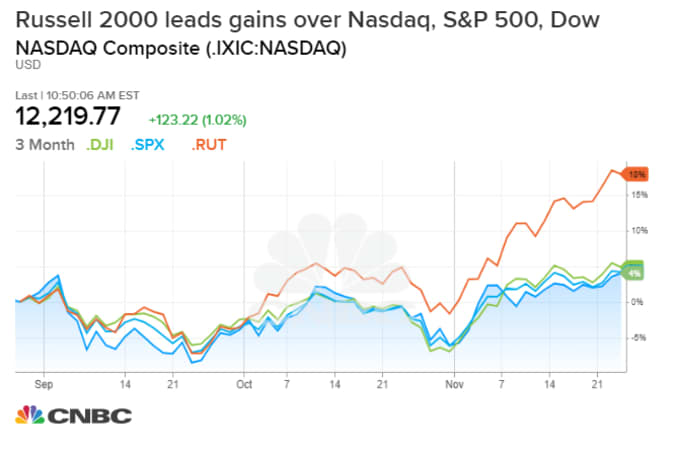

“The death of the tech giant has been announced over and over again, and we see that the market is not leaving them, but is actually moving to greater technology whenever there are problems,” said Quincy Krosby, chief marketing officer at Prudential Financial. “The question posed by the epidemic is whether high technology can work with small and medium scale.” Small caps were one of the most successful in November, while Russell 2000, increased by 20.6%.

“We haven’t seen much sales in Nasdaq,” as investors invest in cyclicals and value, he said. Nasdaq is up 11.9% this month so far, better than the S&P 500.

Experts have warned that there could be a significant increase in viral cases, following a Thanksgiving holiday that could begin to appear next week. There have been more than 12.6 million cases in the U.S.

Job Reports

There are some important economic reports for the coming week, most importantly the employment report for Friday and November. There is also ISM production data on Tuesday.

“My guess is here the data will be valuable because if you listen to the Fed, and if you read the minutes of the Fed, they change here. They are very concerned about the increase in Covid cases, especially the lack of financial support, “said Gregory Faranello, head of U.S. pricing at AmeriVet Securities.

Strategic experts say another important report will be weekly unemployment applications, which has shown an increase in each of the past two weeks. “Employment details have obviously been weakened,” Faranello said. If it continues, it will keep the lid on Treasury product, which delivers different prices.

Jefferies economist Tom Simons expects the dismissal of Census Bureau workers to reduce profits in November, and predicts that the economy will add only 340,000 jobs.

“It’s hard to imagine a strong report coming out on Friday,” said Simons.

Bank of America economists predict that only 150,000 wages will be paid in November, compared to 638,000 in October. The private sector is expected to add 300,000, but the retrenchment of the government is expected to contribute to the full payment of their forecast.

The Vaccine News

Faranello said he expected the bond market to be more active than usual in December due to the expected changes in the White House, as well as the elections in Georgia on January 5 that would decide whether Republicans retain most of their Senate. The market was also concerned about the lack of incentives from Washington.

“The essence of the market right now is really hope and hope compared to the low power and Covid,” Faranello said. “The real question is whether the immunization meeting can last as long as we see the virus go up and we continue to see the extinction. How does the market work as a result? ”

Krosby said he expected the market to look into the news of the vaccine. “The question I think now is whether or not we see the urgent mandate given to Pfizer and then followed by Moderna,” he said. “I think that’s a reason for the market because that’s where you’ll start to see the vaccine spread.” The Food and Drug Administration Advisory Committee has a meeting scheduled for December 10 to discuss Pfizer’s urgent accreditation.

Analysts expect investors to continue to draw on value and cyclicals, as they could benefit more from large-scale technologies that already have high prices. But technology is still appealing.

“We still see Nasdaq moving forward,” Krosby said. “While we enjoy the drug-related explosion in the market, the fact is that investors and retailers are looking for big technical names to provide them with that growth in earnings and revenue.”

Next Week’s Calendar

Monday

9:45 a.m. Chicago PMI

10:00 am Home sales pending

Tuesday

Monthly car sales

9:45 a.m. Manufacturing PMI

10:00 a.m. ISM Production

10:00 a.m. Construction Spending

1:15 pm San Francisco Fed President Mary Daly

Wednesday

8:15 a.m. ADP employment

9:00 a.m. New York Fed President John Williams

10:00 a.m. Philadelphia Fed President Patrick Harker

1:00 p.m. New York Fed’s Williams

2:00 p.m. Beige book

Thursday

8:30 a.m. Initial jobless claims

9:45 a.m. Services PMI

10:00 a.m. ISM nonmanufacturing

Friday

8:05 a.m. New York Fed’s Williams

8:30 a.m. Employment report

8:30 a.m. International trade

9:00 a.m. Chicago Fed President Charles Evans

10:00 a.m. Factory orders

Synopsis

Shares are expected to close in November with some of the biggest gains ever made, thanks to the good news about vaccines.

Next week includes key details, including the November employment report on Friday.

Cycle quantities are expected to continue, but some strategists say tech, which remained slow in the month of November, could start to gain momentum.

Recent Posts

- Sony Unveils PS5 Pro: More Power, Higher Price Tag

- New Starbucks CEO Brian Niccol Has a Turnaround Plan! Will it work?

- Apple Unveils iPhone 16 Pro and Pro Max: A New Era of Performance and Design

- Apple to Unveil New iPhones and Apple Watches on September 9th

- UAE Requests Consular Access to Telegram Founder Pavel Durov Who is Detained in France

- Sony Raises PlayStation 5 Price in Japan

- Jake Paul Reacts to Tommy Fury and Molly Mae’s Breakup

- Telegram Founder Arrested in France: Implications for User Privacy and Security Concerns

- The Journey of Uzair Khan: From Merchant Navy to Prominent Indian Investor and Businessman

- Saqib Malik Launches Prime Authority PR with Guaranteed Media Coverage