News

News

Tesla To Be Included In S&P 500 Index At Once On 21 December

Tesla will be added to the S&P 500 in one step even though it has more than $ 500 billion, the S&P Dow Jones Indices said on Monday, sacrificing a possible split to reduce the impact of adding such a large US stock company.

The stock will be included in its full market capitalization before trading opens on December 21, the index provider said. Floating adjustments mean that only publicly available shares are considered when evaluating a company’s rating. Tesla’s successor will be announced on December 11, according to media reports.

S&P Dow Jones Indices Announcement

The decision follows a response from the investment community, which was demanded by the S&P Dow Jones Indices due to the difficulty of adding a company the size of Tesla. The electric car maker will be the largest company ever added to the S&P 500.

The S&P Dow Jones Indices announced that Tesla would join the S&P 500 in early November. At the time, he said it was being considered whether Tesla should be added all at once before the market opens on December 21, or two lines in December. 14 and December 21st.

“In its decision, S&P DJI has considered the various responses it receives, as well as, among other things, Tesla’s expected payments and market potential for large trading prices on the day,” the index provider said. Tesla’s addition to the S&P 500 will coincide with the end of stock options and stock futures, among other financial instruments, which should help facilitate augmentation due to the high trading volume on that day.

What Are The Experts Saying?

According to Howard Silverblatt, senior analyst at the S&P Dow Jones Indices, Tesla’s adjusted market value of $ 437 billion will result in $ 72.7 billion in the required operations of benchmark index financial managers, in addition to the normal trading activity coming up on December 21.

“The fact that when S&P initially made the announcement they wanted an answer from the investment community on how to manage the increase tells you everything you need to be able to show how this situation is different,” notes Bespoke Investment Group founder Paul Hickey.

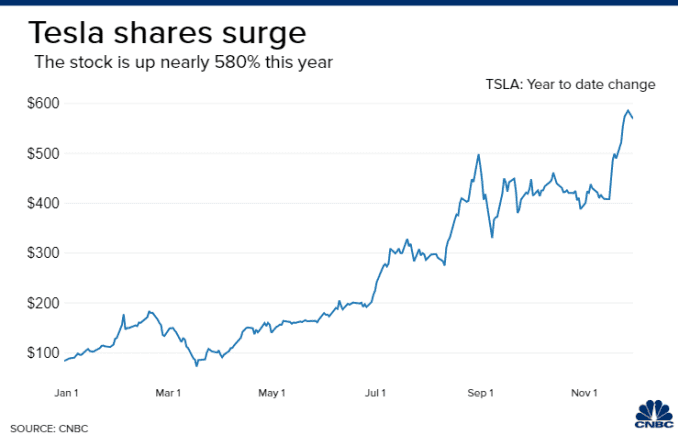

Tesla’s stock has jumped almost 40% since it was announced it would join the index, bringing its annual profit of about 580%.

Hickey mentioned a recent rally on stocks in anticipation that the stock would need to be bought by investors.

Currently there are more than $ 11.2 trillion worth of assets marked on the S&P 500, about $ 4.6 trillion of total indexed funds, according to the S&P Dow Jones Indices.

“There are a lot of changes that need to be made to open up something that will be as big as Tesla’s installation, so there will be a lot of moving pieces that we have to grind,” said Stephanie Hill, head of reference at Mellon. Hill, who oversees nearly $ 350 billion, said with the two options presented by the S&P Dow Jones Indices, adding Tesla to one level makes sense given more market activity on December 21st.

What Happens After Tesla’s Addition?

Goldman Sachs recently estimated that Tesla’s addition could lead to a $ 8 billion demand from major U.S. partners. When the index money is thrown into the mix, that number is much higher.

The company’s inclusion in the S&P 500 was taken as a predictable end after Tesla reported its fourth straight quarter of profits in July – the last obstacle standing in the company’s way. But it passed during the quarterly valuation of the S&P 500’s September, which sent the stocks to fall temporarily.

The composition of the S&P 500 is determined by what is known as the “Index Committee” in the S&P Dow Jones Indices, which analyze quantities as well as quality factors. Finally, the index is designed to represent the U.S. market.

Tesla shares acquired more than 4% in expanded trading following the announcement.

Recent Posts

- Feeling the Pressure at 25–30? Here’s Why Young Adults Think Time Is Running Out

- BTS Is Back! All Seven Members Complete Military Service—What’s Next for the K-Pop Kings?

- Diddy’s Blockbuster Trial Nears Verdict: What’s Next for the Hip-Hop Mogul?

- “Squid Game” Final Season Sparks Global Buzz Ahead of Premiere

- Beyoncé and Jay-Z Reunite Onstage in Paris: A Night to Remember

- Texas Bets Big on Film: $1.5 Billion Incentive Law Aims to Bring Hollywood Home

- Starbucks Considers Selling Its China Business Amid Fierce Local Competition

- JetBlue Retreats from Miami and Seattle Amid Mounting Financial Pressures

- Barbra Streisand Calls Out Hollywood’s Pay Gap in Meet the Fockers Revelation

- Elon Musk’s Robotaxi Revolution: A Cosmic Ride into the Future