Warren Buffett made some notable investment changes in the second quarter.

In a regulatory filing detailing its U.S.-listed investments as of June 30, Berkshire also disclosed a new 20.9 million share investment worth $563.6 million in Toronto-based Barrick Gold Corp (ABX.TO), one of the world’s largest mining companies.

Buffet Dumped JP Morgan And Wells Fargo Stock

Buffett’s Berkshire Hathaway (ticker: BRKb) slashed its position in JPMorgan Chase (ticker: JPM), exited investments in Occidental Petroleum (OXY) and Goldman Sachs, and bought more Kroger (KR) stock, and initiated a position in Barrick Gold (GOLD). Berkshire Hathaway disclosed the trades, among others in a form it filed with the Securities and Exchange Commission.

Meanwhile, the investment firm acquired nearly 21 million shares of Barrick Gold worth $563 million, representing 0.3% of Berkshire’s holding. Berkshire also reduced its holding in PNC Financial Services (PNC), selling 3.85 million shares to cut its position to 0.3% from 0.5%.

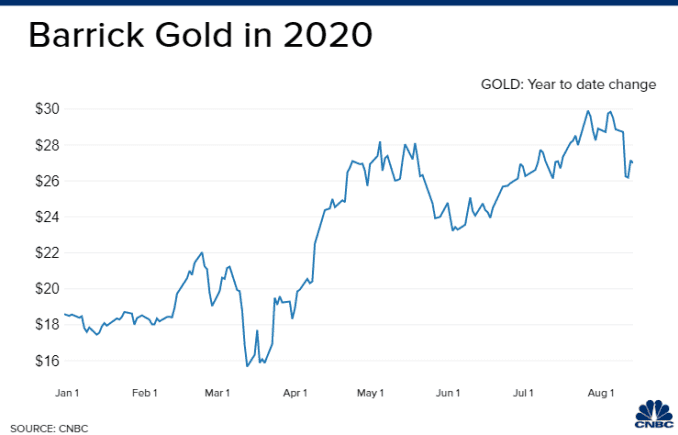

Barrick Gold’s Stock Surges

Barrick Gold’s stock is popping 10% Monday after legendary investor Warren Buffett’s Berkshire Hathaway revealed a stake in the gold miner’s stock.

Berkshire added a $562 million position in Barrick Gold in the second quarter, according to SEC filings Friday. While the position is small for Berkshire — which owns more than $89 billion in Apple stock — the conglomerate is the 11th largest shareholder of the gold mining company, according to FactSet.

This was an unusual move considering Buffett, a long-time value investor, has long professed a dislike for gold, preferring assets that have cash flows or pay dividends.

Shares of miner have surged more than 45% this year as investors rush into the safe haven metal trade during the coronavirus pandemic. Gold prices have had a banner year, topping $2,000 per ounce this month for the first time ever on worries about the impact of Covid-19 on the economy and lower bond yields. Spot gold has rallied nearly 30% in 2020, making it one of the the best-performing mainstream assets this year.

Barrick Gold has gold and copper mining operations in 13 countries. Its shares trade on the New York Stock Exchange under ticker GOLD.

To be sure, because Berkshire Hathaway’s position in Barrick Gold is relatively small, one of Buffett’s investing lieutenants, Ted Weschler or Todd Combs, could be responsible for the purchase rather than the Oracle of Omaha.

More About Barrick Gold

Barrick Gold Corporation is a mining company that produces gold and copper with 16 operating sites in 13 countries. It is headquartered in Toronto, Ontario, Canada.

Barrick had been the world’s largest gold mining company until Newmont Corporation acquired Goldcorp in 2019. Barrick expects to produce between 4.6 to five million ounces of gold and between 440 to 500 million pounds of copper in 2020.

Chief executive Mark Bristow has said Barrick has debated moving its primary stock listing to the New York Stock Exchange from the Toronto Stock Exchange, allowing it to be traded on the S&P 500 Index and broadening its exposure to potential investors.

Barrick Gold Corporation evolved from a privately held North American oil and gas company, Barrick Resources. After suffering financial losses in oil and gas, founder Peter Munk (1927–2018) decided to refocus the company on gold. Barrick Resources Corporation became a publicly traded company on May 2, 1983, listing on the Toronto Stock Exchange.

Leave a Reply

You must be logged in to post a comment.