After investors have spent a decade investing in Silicon Valley start-ups so that they can continue to grow while remaining private, the pendulum has swirled around, and technology IPOs are bigger than ever.

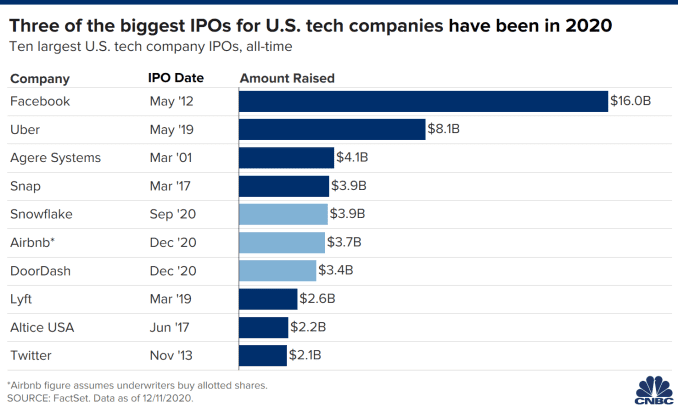

Three of the 10 largest technology IPOs in U.S. companies, in terms of revenue, have been made this year. The two happened on consecutive days last week, when DoorDash and Airbnb started trading on December 9 and 10. One was software developer Snowflake, which first appeared on the New York Stock Exchange in September.

Sustained Bullish Sentiments

Each of them has raised more than $ 3 billion and has a market capitalization of between $ 55 billion and $ 100 billion, which puts it among the top 30 most important U.S. companies. Before going public they ordered double billions of dollars, attracting large checks on the way from private firms, fund managers, strategic investors and treasure trusts.

High-value technology companies take advantage of the ongoing bull market despite nine months of the coronavirus epidemic and a catastrophic year in the wider economy. A healthy list of emerging software companies, including names for cloud software such as UiPath and Databricks, could fill the pipeline by 2021.

“With the acquisition of a lot of VC funding and other private funding sources from the private fund and joint funding for pre-IPOs has raised the prices of private markets,” said Jay Ritter, University of Florida professor of finance and IPO specialist. That “allowed companies such as Snowflake, DoorDash and Airbnb to be allowed to raise private funds on attractive terms, and they were not in a hurry to come forward as a result.”

While major contributions to 2020 may be in the background, there is still at least one billion-dollar deal expected before the end of the year from e-retailer Wish even though sports company Roblox has reportedly pushed its IPO to 2021.

To extend the deadline by one year, prior to the epidemic, two other companies – Uber and Lyft – are joining the ranks of the top 10 U.S. IPOs. Uber raised more than $ 8 billion in May 2019, making it the second largest, after Facebook alone, with more than $ 16 billion in 2012.

Lyft raised $ 2.6 billion in March 2019, and is eighth on the list.

Expensive Business Model

Four of the five offerings between 2019 and 2020 – Uber, Lyft, DoorDash and Airbnb – are leaders in a shared economy, meaning their models are based on peer-to-peer markets. They connect businesses and consumers technically and technically and cut everything that is done.

All four companies rely on a large amount of foreign exchange to grow their networks, promote their services, spread rapidly into new markets, hire aggressively and offer incentives on both sides of the market. With all the money laundering, Airbnb alone recorded a full profit in the last quarter, and that was after reducing its sales and marketing costs and hitting its employees by 25% as a result of the epidemic.

Snowflake IPO

Snowflake is unique: It sells cloud software and relies on traditional vendors. Ice Fund raised $ 3.9 billion in September, the largest software IPO. The offering listed Snowflake at $ 33 billion, which is twice the number when the company started trading.

It was a kind of first-day pop that annoyed IPO critics, who complained that technology companies were leaving a lot of money on the table, offering free offers to new institutional investors. DoorDash and Airbnb did not help, exceeding 85% and 112%, respectively, exiting the gate.

In other words, even though they have accumulated more money in their IPOs than any other technology company before them, their performance suggests that they could have made more money without further mixing.

“Except for the dot-com era (1999-2000), I have never seen anything like it in so many companies,” wrote David Golden, a partner in Revolution Ventures in San Francisco who previously managed investment technology at JPMorgan, in an email. “And the values do not seem to be included in any of the analytical metrics that I have understood.”

An earlier donation of the top 10 milked every penny they could get from their IPOs. Facebook was flat at its inception before trading below in the coming weeks. Lyft woke up slightly on its first day and went down, while Uber sank quickly.

DoorDash And Airbnb IPO

DoorDash and Airbnb pops were notable because companies used a hybrid auction model for their IPOs. Managers have been able to solicit bids from investors and look at the entire order book before deciding on a price, giving them the best power to sell shares according to real need, without giving them a standard discount.

Both companies raised their first list and then priced higher. However, the shares were released publicly. Ritter says if it weren’t for a hybrid auction, it would be a lot worse.

“Without the need for investors to submit a price and price to their orders that allow them to see the demand curve, my bet is that subscribers would recommend a much lower price,” Ritter said. “Obviously they left a lot more on the table than they needed to.”

Synopsis

Airbnb and DoorDash, which came to light on consecutive days this week, were the sixth and seventh largest IPOs in U.S. technology companies.

The Snowflake IPO in September was the fifth largest and largest software company ever.

This follows a trend from 2019, when Uber and Lyft went public, each raising billions of dollars.

Leave a Reply

You must be logged in to post a comment.